What have European consumers chosen to spend their money on in the first half of 2024? Find out in the GSG H1 2024 Consumer Spending and Behaviour Report.

We analysed consumer spending and behaviour from the first 6 months of 2024 across Germany, France, the UK and Spain. The report is based on a subset of GSG data across more than €1bn in spending and tens of millions of transactions. In this report, we outline our findings, looking at:

- What people are spending their money on in each country

- Which products and retailers were trending based on search insights

- Purchase behaviour – what days and time of days consumers spend, and what devices they use

Read on to discover the trends we see in each country during the first 6 months of the year and what this says about consumer behaviour in each of them.

Contents

Summary

Consumers have spent a significant amount on travel in all countries, and in general spending on travel has increased in 2024 compared to 2023.

UK consumers prefer shopping on mobile, while in Germany, France, and Spain they prefer desktop.

Saturday is the least popular day for online shopping in all countries, with the most popular day being different in each country (Germany – Sunday, France – Monday, UK – Monday, Spain – Tuesday). Overall, Monday had the highest combined transaction share across countries.

Germany

In Germany, spending overall has increased compared to last year; it was higher every month in 2024 than in 2023 except for January. This suggests that consumers are bullish and confident about their prospects, perhaps buoyed by lower inflation and a stabilisation of interest rates.

Based on millions of transactions and more than €400m of spending, other key insights include:

- Spending on travel continues its strong growth from 2023, driven by a mixture of strong demand and higher average spend per transaction

- German consumers have bought more electronics and gadgets in 2024 compared to 2023, but spent less on fashion

- Sundays were the busiest days for online shopping while Saturdays were the least busy. Overall, 3pm-9pm were the peak times for online shopping, with 39.4% of transactions being made between these hours

Spend on travel continues its hot streak

Our data shows that German consumers spent more on travel in 2024 than in 2023. The industry has experienced something of a boom in the past couple of years and that has continued into 2024. Heading into the year, some had predicted headwinds for the industry and a slowdown in spending, but in Germany, those predictions don’t seem to have materialised.

Demand for flights increased by 4.8% in the first half of 2024 compared to 2023. Spending on hotels and accommodation also jumped; a lot of the growth was driven by strong promotions by one of the leading accommodation booking sites which looked like it encouraged consumers to book more stays.

In relative terms, we also saw a big jump in spending on travel experiences (e.g. tours and activities). Two of the leading sites for booking travel activities saw transactions increase by 30% in 2024 compared to the same period in 2023.

Tech another winner

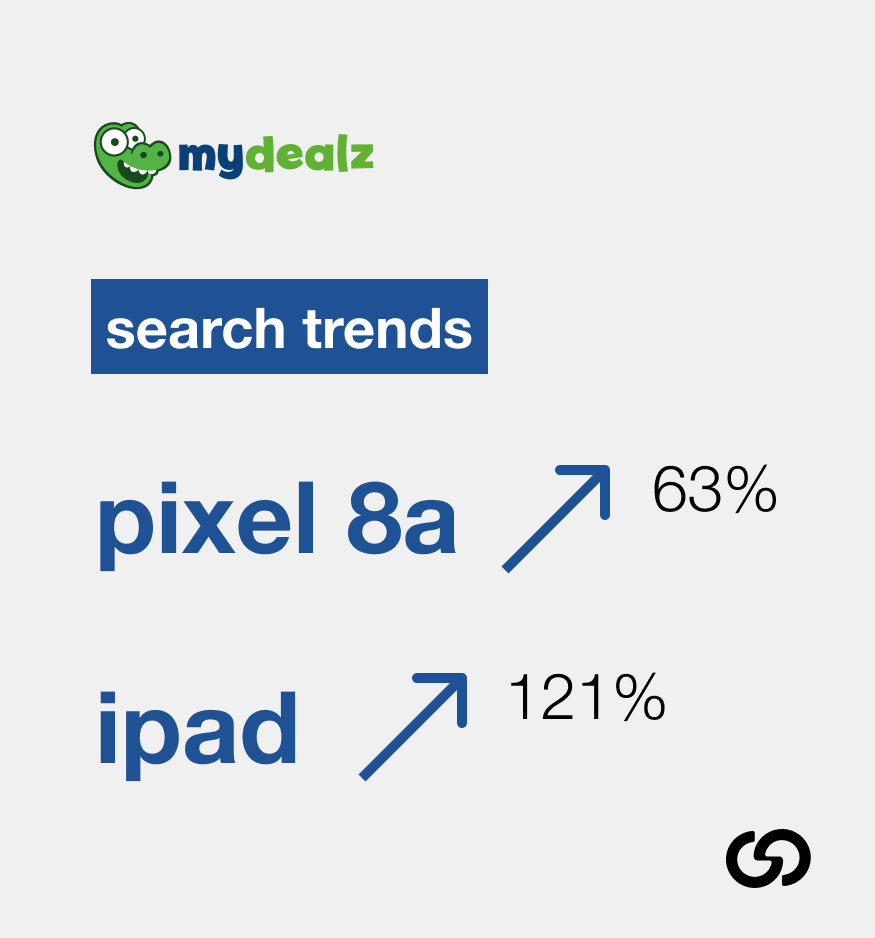

Consumers have been spending more on electronics and gadgets this year compared to last year. In May, interest in the newly released Google Pixel 8a spiked; searches on mydealz for ‘pixel’ jumped by 63% in the week the device was released (with searches specifically for ‘pixel 8a’ up by over 5000% in the same week). During the same month, there was also clear interest in the new iPad Pro lineup that Apple announced with a 121% increase in searches on mydealz following its launch.

Perhaps counterintuitively, the closure of a well-known retailer may have driven some of the demand for tech. In March, Gravis, a popular electronics retailer and one of the biggest Apple dealers in the country, announced it would be closing its doors in June. In May, shortly before its closure, deal hunters looked to snap up bargains as the retailer sold off its stock; weekly searches for the brand on mydealz increased by almost 3,000% in late May.

Fashion less of a priority

One of the sectors that saw lower demand, however, was fashion, with spending down 12% year-over-year. Fast fashion seems to have been hit especially hard, with spending at the best-known fast fashion retailers down by almost 17%. The luxury segment, on the other hand, has remained resilient with spending largely flat year-over-year.

The data reflects concerns fashion industry executives voiced in a McKinsey report released earlier this year, which claimed “fashion leaders are anticipating headwinds and are uncertain about prospects for the year ahead”.

Paired with the increase in travel spending, an easy conclusion would be that consumers in Germany are spending more of their money on experiences than material goods. However, the increase in spending on gadgets and technology suggests this kind of broad generalisation isn’t true. It may be that consumers are becoming more discerning about how and where they spend their money, though.

Desktop remains king

When it comes to how consumers in Germany are choosing to shop, there is something of a surprise. Although mobile shopping has been on the rise in recent years, our data shows that consumers still prefer shopping on desktops in Germany. In fact, the share of transactions on desktop increased in 2024 compared to 2023. 58.6% of transactions were completed on desktop in the first half of 2024 compared to 55.8% in 2023. 40.4% of transactions were done on mobile devices in 2024 (compared to 43% in 2023) and just 1% of transactions were made on other devices such as tablets (compared to 1.2% in 2023).

Sunday is the favourite day for online shopping

During the first 6 months of 2024, Sunday was the busiest day for online shopping, capturing 16.5% of transactions. This is perhaps unsurprising as the vast majority of shops are closed on Sundays across the country, so consumers have to go online to get their shopping fix. The next most popular day was Monday, taking 15.1% of transactions – perhaps driven by people completing purchases they researched on the weekend or chasing a pick-me-up at the start of the week. Saturday, on the other hand, was the least popular day for online shopping, capturing just 12% of transactions. One possible explanation for this is that shoppers reserve Saturdays to go to brick-and-mortar stores.

When it comes to times of the day that people prefer to shop, activity tends to increase throughout the day and peaks in the afternoon and early evening. Almost 40% of transactions took place in the six-hour period between 3pm and 9pm, with shoppers most active between 6pm and 8pm – at the end of the typical work day for many people.

France

In France, overall spending was up by around 12% in the first half of 2024 compared to the first half of 2023.

Based on millions of transactions and over €300m of spending, other key insights include:

- French consumers spent more on travel in 2024 compared to 2023 so far, with spending up 20% year-over-year; the biggest winner within the travel segment was hotels and accommodation, with spending up 39% year-over-year

- Fashion saw the lowest increase in spending

- French consumers have been ditching their phones in favour of computers, with just 35.7% of transactions made on mobile devices so far in 2024, compared to 40% in 2023

French consumers prioritise travel

Consumers have shown a clear preference for spending on travel over material goods in the first half of 2024, with the category taking a 39% share of overall spending. It was also the second highest growing category, with spend increasing just over 20% year-over-year, outstripped only by the technology category (which grew at 24.4%).

Within the travel category, consumers spent more on transportation, flights, and online travel agencies and aggregators.

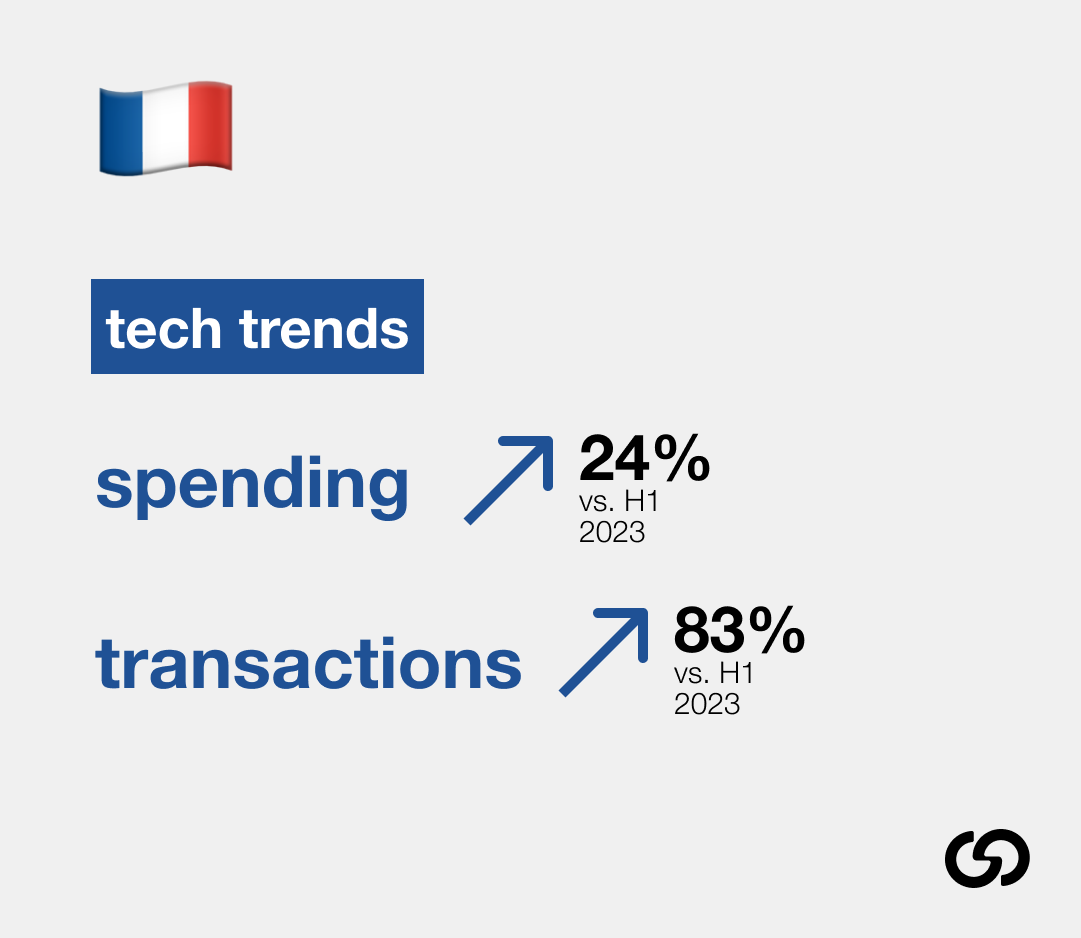

More tech purchases but lower average spend per transaction

Tech spending grew by over 24% in the first half of 2024 compared to 2023. Interestingly, though, the total number of transactions in the category increased by a whopping 83%. This would seem to suggest that consumers in France are buying tech and electronics products more frequently but opting for smaller, less valuable items each time – but that’s not entirely true.

It is true that the average order value in the tech category has decreased. One of the reasons for this is the rise of Temu, which encourages people to ‘shop like a billionaire’. Since the latter half of 2023, spending at the Chinese marketplace has exploded across Europe, but with many products priced below €10 and even the most expensive products only costing in the low hundreds of €, the average transaction at the marketplace tends to be much lower than at other tech retailers. The result is that the average order value within the tech category as a whole has come down.

That said, if we take Temu out of the picture, the average order value in the tech category has actually increased year-over-year by almost 17%. That has been driven by increased spending on home appliances and higher value electronic goods such as laptops, computers and mobile phones.

Desktop grows in popularity

Shopping on desktop grew in popularity in 2024 compared to 2023, with the medium capturing 63.68% of transactions compared to 59.11% in 2023. The share of transactions on mobile devices decreased year-over-year, from almost 40% in 2023 to 35.7% in 2024. That’s despite the rise of Temu, generally considered a mobile-first retailer.

French consumers prefer shopping online on Monday

Perhaps as an antidote to the post-weekend blues, Monday proved to be French consumers’ favourite day for online shopping. It captured 15.9% of transactions, with Wednesday the next favourite day at 15.8%.

Saturday, on the other hand, captured the lowest share of transactions at just 11.5%. This trend is reflected across Europe, and could indicate a tendency to shop at brick-and-mortar retailers on Saturdays – or simply have a break from shopping altogether.

United Kingdom

In the United Kingdom, based on insights from more than €300m of spending and millions of transactions in the first half of 2024, we found:

- Consumers in the UK spent most heavily on travel, showing a particular affinity for travel agencies and package holidays.

- They also spent a significant amount on food delivery services and fashion, although fashion spending seems to be on something of a downward trend.

- Mobile shopping is popular in the UK (more so than in other European countries such as Germany and France), and Monday is the most popular day for online shopping.

Brits love a package holiday

As a category, Brits spent the most on travel in the first half of 2024, with the vertical taking approximately 22% of total spend. Of that, almost half of the spending was with travel agencies and package holiday providers.

British holidaymakers have something of a reputation for enjoying package holidays and the data suggests this continues to be the case. A 2023 survey showed that the top reason for UK consumers to take all-inclusive holidays is that they believe they offer good value for money and take away the worry of having to account for lots of additional spending money. And, although consumer confidence has been on the rise since early 2023 in the UK, consumers remain somewhat cautious about spending.

Takeaways gobble up a large piece of the pie

British consumers also spent a significant amount in the ‘lifestyle’ category in the first half of 2024. This includes sub-categories such as food and drink, entertainment, pets, and car parts, and while this category attracted lower spending than travel, it had the highest overall transaction volume.

Spending was driven by a large number of purchases in the food and drink category, and the two highest individual retailers within that group (by both transaction volume and amount spent) were food delivery services. One of those retailers was also one of the leaders by total spend across all categories. There was also a significant spike in interest in a specific retailer, Just Eat, during April; this was due to the launch of an Apple Pay promotion which gave users £12 off orders of £20 or more. In the week this promotion was launched, searches for the brand increased 213% compared to the previous week.

Consumers invest in home improvements

Consumers spent significantly this year on home furnishings and DIY; the broader home and garden category captured 6.8% of total spend across all categories, and the most popular retailers in the category were furniture and DIY retailers. Specific promotions also contributed to this. For example, in June, an attractive IKEA offer drove interest in the brand on hotukdeals. Between 3-9 June, searches for the brand increased by 594% compared to the previous week, and across the whole month of June, searches were up around 380% compared to May.

Mobile shopping takes first place

When it comes to device choice, UK consumers prefer shopping on mobile over desktop or laptop computers. In the first half of 2024, just over 61% of transactions were made on mobile devices, compared to just over 37% on desktops and less than 1.5% on tablets.

In this way, consumers in the UK are different from their counterparts in Germany, France and Spain, who, perhaps surprisingly, still shop more on desktop and laptop computers than they do on mobile devices.

Online shopping peaks on Mondays

Monday was the busiest online shopping day of the week, taking 15.4% of transactions, and Wednesday was the second most popular day at 14.6% of transactions. Saturday, on the other hand, was the quietest day, capturing just 13.3% of transactions – a trend that is reflected across Europe.

Reasons for this could be that people look for a pick-up on Monday after the weekend, while on Saturdays they prioritise other activities or visit brick-and-mortar stores rather than shopping online.

Spain

In Spain, based on insights from more than €60m of spending and over a million transactions the first half of 2024, we found:

- Consumers in Spain spent most heavily in the ‘lifestyle’ category, which includes categories such as health and beauty, food and drink, entertainment, pets, and gifts.

- Travel was also a popular category, with hotels and accommodation and travel agencies two of the biggest categories within travel

- Tuesday was the most popular day for online shopping with Saturday by far the least popular day

Spaniards love health and beauty products

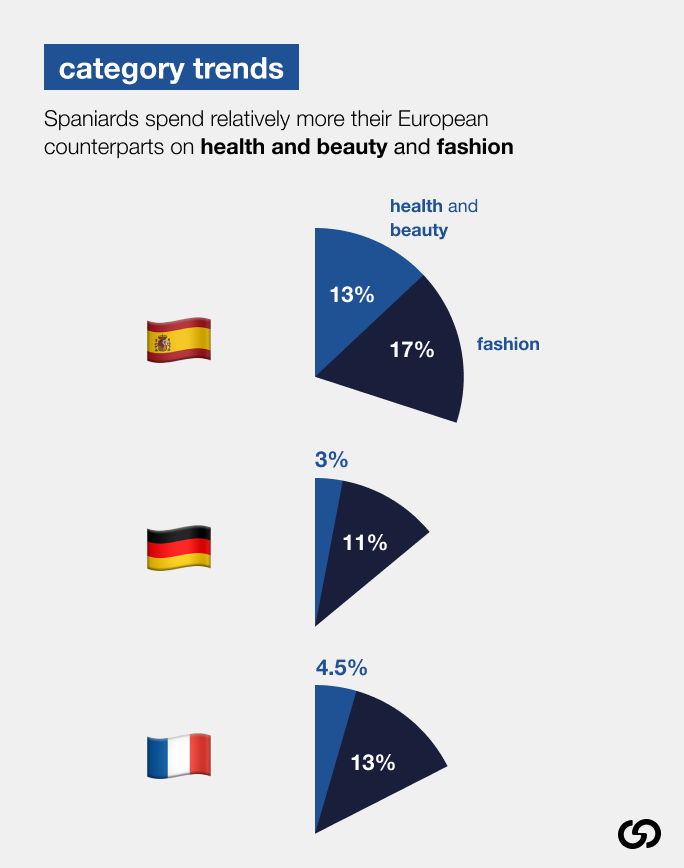

Our data shows that the health and beauty category accounted for a significantly higher proportion of overall spending in Spain than in other European countries during the first half of 2024. It captured close to 13% of total spending compared to just over 3% in Germany and almost 4.5% in France. Particularly strong here were online retailers selling perfumes, makeup and cosmetics. On average, Spanish consumers spent €47 per purchase in this category.

Fashion is another area where Spaniards spend relatively more than their European counterparts; the category makes up over 17% of total spending in Spain, compared to 11% in Germany and 13% in France. There we can also see the impact of Chinese players with Shein taking a significant share of fashion spending.

Multi-department retailers a big winner

Consumers in Spain spent big at so-called ‘multi-department’ retailers – these are companies that offer a wide range of products and includes names such as Amazon, Miravia, AliExpress and Temu.

As we’ve seen elsewhere in Europe, emerging Chinese-owned marketplaces have grown significantly in popularity over the last 12 months. In the first 6 months of 2024, aggressive promotions by such marketplaces have seen them become some of the top individual retailers by total spend; the three top Chinese retailers in Spain captured 40% of the total spending in the ‘multi-department’ category and just under 7% of overall spending.

Pizzas and fans grab deal hunters' interest

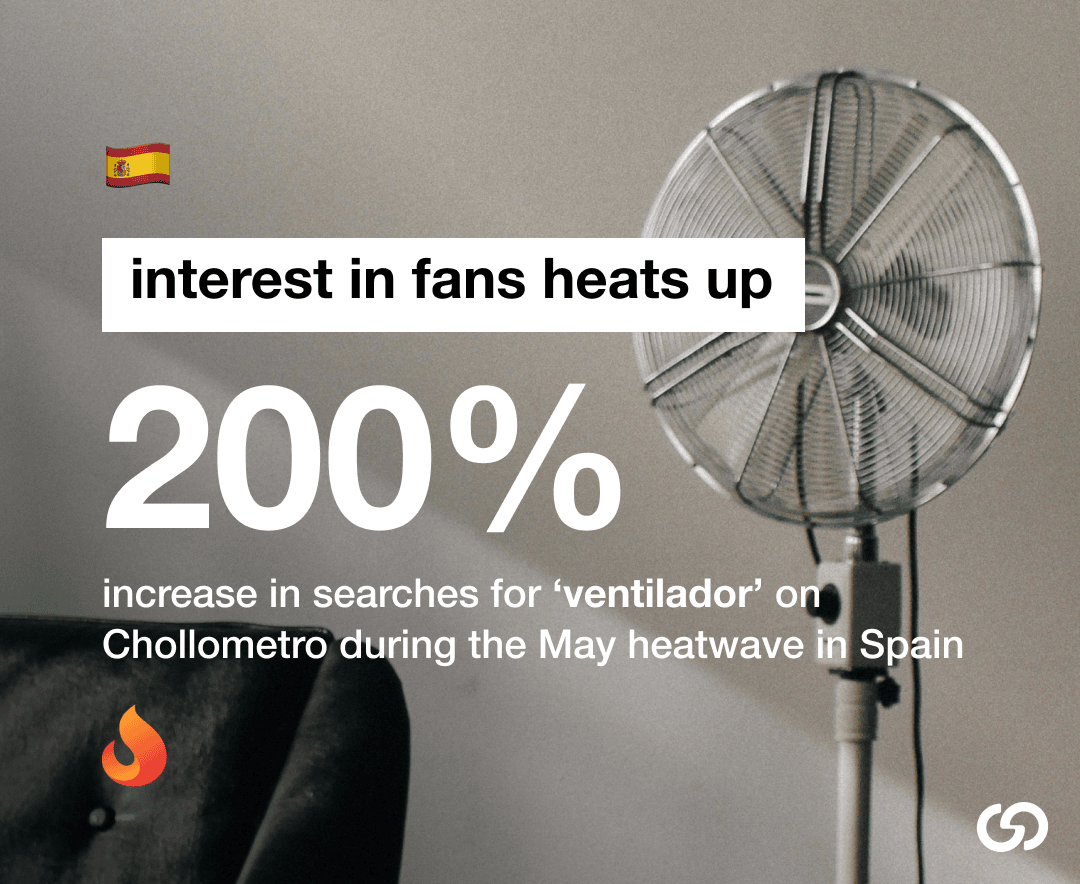

We saw two interesting things in search data from Chollometro, Spain’s leading deal community. In May, with parts of Spain experiencing its hottest May ever and temperatures reaching more than 40C in some areas, searches for ‘ventilador’ (‘fan’ in Spanish) increased week-over-week by almost 200%. Data from Spanish real estate website Idealista suggests that just 41% of homes in Spain have air conditioning, so it appears consumers are turning to fans to combat the heat as practical and cheaper alternatives to air conditioning units.

We also saw a spike in searches for ‘Telepizza’, a well-known pizza chain in Spain, in late June. Week-over-week searches for the brand were up by 265% between 17-23 June compared to the previous week. This interest was driven by a deal on Groupon that offered pizza-lovers a medium pizza with up to three toppings for just €2.99 – although they had to pick up the pizza themselves!

Tuesday the most popular day for online shopping

Tuesday just pipped Monday to the post as the most popular day for online shopping. It took a 16.4% share of transactions compared to 16.1% on Monday, with Wednesday the third most popular day at 15.3% of transactions.

Saturday was the least popular day with just 10.9% of transactions, mirroring the behaviour we saw in Germany, France, and the UK.

In terms of the times of day when Spaniards like to shop, they are most active in the early evening between 6-10pm, with 7-9pm being the peak hours. However, mid-morning is also a popular time to shop, especially between 10am-12pm. Interestingly, the peak hours for shopping on desktop are between 9am-12pm on weekdays (Monday-Friday) while mobile shopping peaks in the evenings (7-10pm) every day.