We have just released a new guide that explores whether cashback platforms drive incremental value for online retailers and brands. Read on for a summary and download the full guide here.

Incrementality. Search for the word in a dictionary and you won’t find it. In the marketing world, though, you’ll frequently hear it used. So, what does it mean, how can you measure it, and does cashback as a channel deliver incremental value? That’s exactly what we decided to explore in our new guide, Beyond Discounts: How Cashback Sites Drive Incremental Value.

What is incrementality?

In short, incrementality refers to the additional value generated by a marketing campaign or channel. CJ defines it as the “additional value the channel provides that would not have occurred without the channel present“. This means you can use different metrics to measure incrementality, such as new sales, average basket size, purchase frequency, and even average marketing cost per customer. Important: new sales are not the only measure of incrementality – don’t fall into the trap of thinking they are.

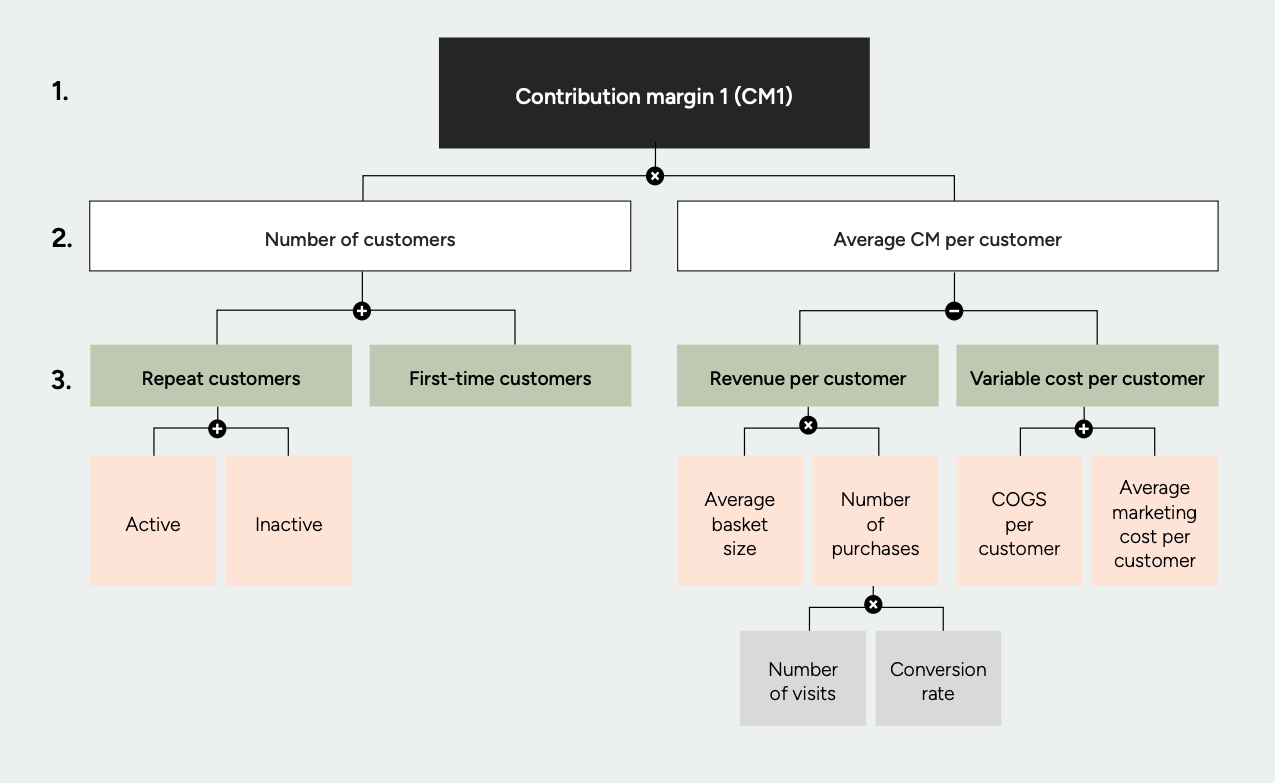

We developed the following methodology to look at incrementality with contribution margin (i.e. revenue mins variable costs) as the ultimate goal:

Here’s how to read it:

- The north star metric is contribution margin 1 (CM1), i.e. revenue minus variable costs.

- Two primary metrics affect CM1 – the total number of customers and the contribution margin per customer, and each of these is affected by the total number of customers and your contribution margin per customer

- Each of these metrics can be influenced by various levers, such as average basket size, purchase frequency, and average marketing cost per customer

Almost every metric (or lever) shown above can drive incremental value. However, from our experience, these six are the ones that tend to be most relevant for marketers (as they are the metrics that marketers can have the most impact on):

- First-time (or new) customers

- Repeat customers

- Average basket size

- Purchase frequency (i.e. number of purchases per customer)

- Average marketing cost per customer (or per sale/conversion)

- Conversion rate

We go into each of these and look at how cashback sites can impact them in the guide.

Do cashback sites drive incremental value?

That’s the big question. In the guide, we explore each of the six incrementality drivers highlighted above to see what the data and user insights say about each of them. Here’s a summary:

- First-time customers: Cashback campaigns can attract new shoppers by offering higher rewards for their first purchase.

- Repeat customers: Cashback fosters loyalty, with 73% of users reporting higher affinity toward brands that offer rewards.

- Average basket size: Users on cashback platforms tend to spend 46% more per transaction compared to average shoppers.

- Purchase frequency: Promotions on cashback sites can more than double the purchase frequency at retailers running the promotions compared to competitors that aren’t.

- Marketing cost per customer: With performance-based payouts, cashback can lower acquisition costs compared to traditional channels.

- Conversion rate: Cashback users convert at rates up to 188% higher than non-affiliate traffic.

If that has intrigued you, there’s not much more to say: download and read the full guide now.