Following a boom in eCommerce sales during the pandemic, in 2022 year-over-year sales dropped. But now, as Global Savings Group publishes its eCommerce Mid-Year Report 2023, the good news is that eCommerce is growing again.

The next 1-2 years are still expected to be challenging, but we predict eCommerce growth to be 5% higher than it was before the pandemic. It’ll also stabilize in the following years.

We dive more into the trends below, looking at the rise of social commerce and Chinese players entering the European market.

Key Takeaways

01

eCommerce growth to be 5%

The next 1-2 years are still expected to be challenging, but we predict eCommerce growth to be 5% higher than it was before the pandemic. It’ll also stabilize in the following years.

02

Social commerce on the rise

Social networks are now the second most popular method used by consumers to find new products, and sales from social commerce could hit the $2 trillion mark by 2025.

03

Chinese players making a splash

With their aggressive push into Europe, up-and-coming Chinese eCommerce companies like Temu and Shein are disrupting existing European eCommerce players.

Social Commerce Sales to Hit $2 Trillion

GSG sees two main growth drivers on this path forward for eCommerce in Europe:

01

On the one hand, social networks have become the second most popular method used by consumers globally to search for products to purchase, just behind search engines.

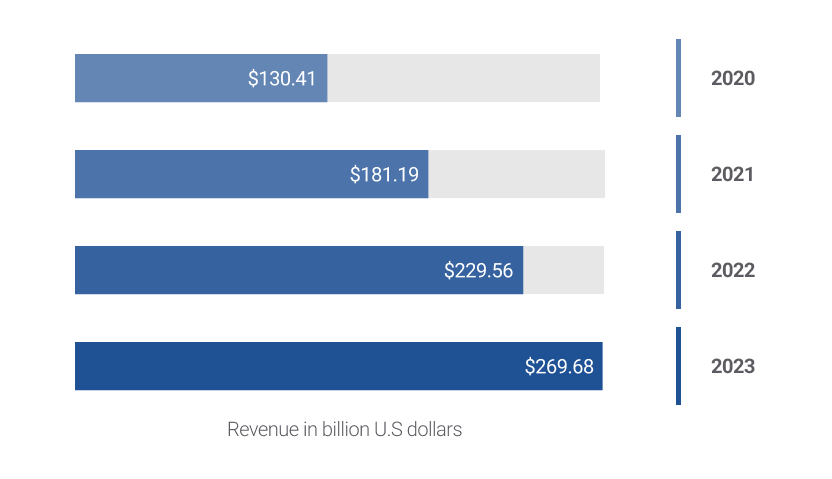

Almost one-third of businesses expect to increase social media marketing to drive company growth over the next few years. Spending on social media ads worldwide went up more than 38% between 2020 and 2022, rising to almost $230 billion in 2022.

Social Media Advertising Spending Worldwide

Statista anticipates global sales in social commerce will surpass the trillion-dollar mark in 2023 and soar to $2 trillion by 2025.

02

On the other hand, Chinese eCommerce players are continuously increasing their presence in European markets. Even more than their EU or U.S. counterparts they understand and master the combination of commerce and social media. The combination of the growing importance of social commerce and the aggressive market push of skilled Chinese players like Temu, Shein and Alibaba will disrupt the well-settled EU eCommerce business significantly in the upcoming months.

Dr. Gerhard Trautmann, Co-Founder & CEO Global Savings Group:

“The eCommerce Mid-Year Report 2023 brings both optimism and caution. While eCommerce is showing signs of growth again, we recognize that the next one to two years will continue to present challenges.

We project a 5% increase compared to pre-pandemic levels, with further growth in the following years. We will continue to see that discovery-based shopping apps, such as Temu, will keep on leveraging the trend that social media and commerce will continue to converge. They are presenting you with an infinite scroll of things you might want to buy in a very entertaining way. That is one great example of how brands have to master adding social media elements to their eCommerce infrastructure.

The arrival of new competitors from China is going to heat up the European eCommerce battle immensely, with a lot of change ahead.”

Consumer Confidence is on the Rise

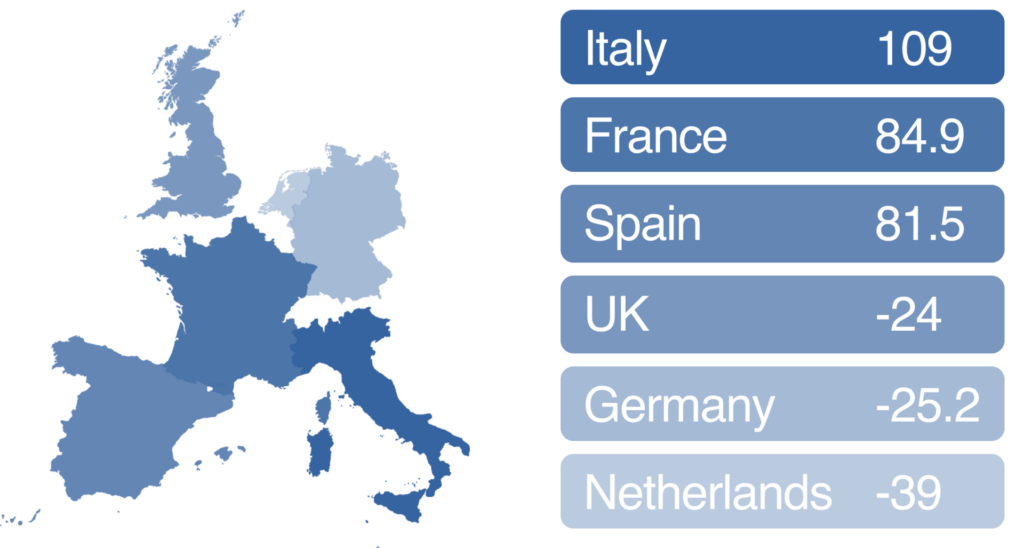

There has been a clear increase in consumer confidence in recent months, which has led to an increase in consumer spending. In Europe, France leads the way in the consumer confidence index at 85, while the UK had the lowest at -24.1. There has also been a notable increase in spending in specific categories.

Consumer Confidence in EU and UK

According to a survey conducted by PwC, 46% of respondents expect to increase spending on groceries in June, up from 42% in February. Asked about less essential products, they predict a more dramatic increase in spending, 36% of respondents say they’ll spend more on clothing and health/beauty products, an increase of 28% and 27% respectively in February.

“As we look into the various eCommerce verticals, we find immense potential for growth. The Electronics niche holds promise, with spending led by the UK and Germany, but Spain shows substantial growth. The Fashion market is also on a growth trajectory, with China driving most of the revenue, and Spain experiencing significant expansion.

In Beauty, Health, Personal & Household Care, Germany and the UK lead in revenue, while the UK showcases impressive growth. Lastly, the Furniture market offers opportunities, with the United States being the primary revenue generator.

In this ever-changing landscape of global eCommerce, we at Global Savings Group (GSG) remain steadfast in our commitment to providing the best shopping experience for our community and as the world’s largest shopping community, recommendation, and rewards platform, connecting brands and retailers with consumers across more than 2 billion purchase journeys annually,” Trautmann continued.

Affiliate Marketing Remains Resilient

Outlook by Vertical

Electronics

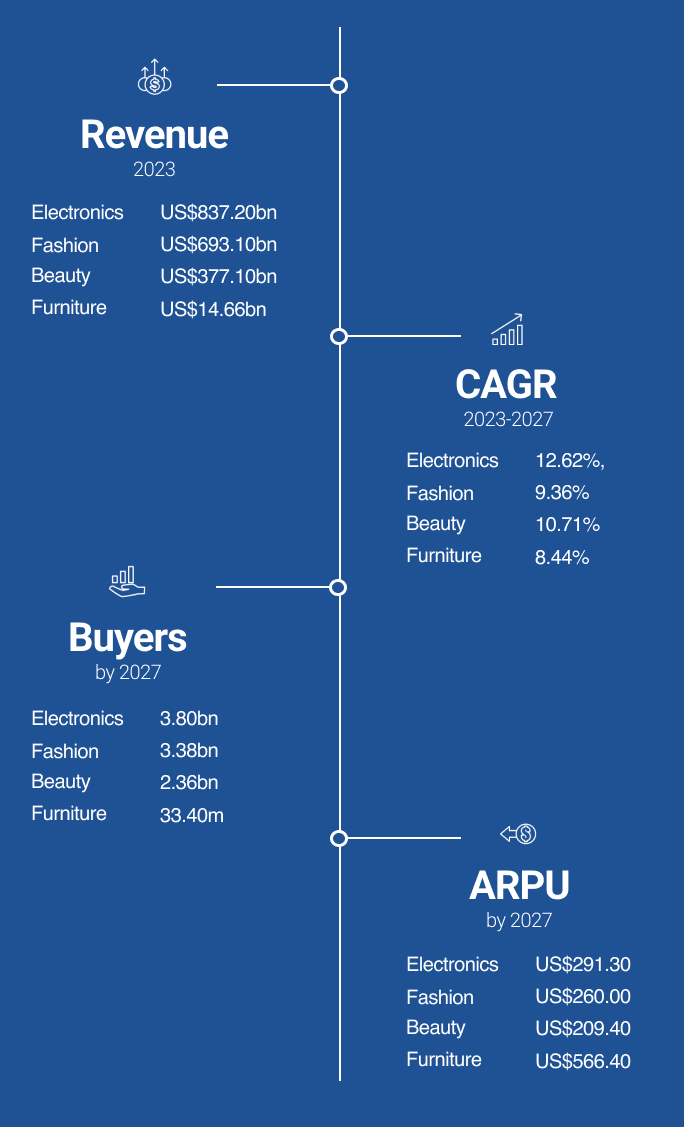

Revenue in the Electronics market is projected to reach US$837.20bn in 2023.

Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 12.62%, resulting in a projected market volume of US$1,347.00bn by 2027.

In the Electronics market, the number of buyers is expected to amount to 3.80bn by 2027. User penetration will be 37.4% in 2023 and is expected to hit 47.9% by 2027.

The average revenue per user (ARPU) is expected to amount to US$291.30. UK is the country leader in the Electronics vertical, followed by Germany, although Spain presents the highest growth, followed by the UK.

Fashion

Revenue in the Fashion market is projected to reach US$693.10bn in 2023.

Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 9.36%, resulting in a projected market volume of US$991.40bn by 2027.

With a projected market volume of US$226.90bn in 2023, most revenue is generated in China.

The number of buyers is expected to amount to 3.38bn by 2027. User penetration will be 34.7% in 2023 and is expected to hit 42.6% by 2027.

The average revenue per user (ARPU) is expected to amount to US$260.00. The UK is the country leader in online fashion revenue, nevertheless, Spain is the market experiencing the highest growth.

Beauty, Health, Personal & Household Care

Revenue in the Beauty, Health, Personal & Household Care market is projected to reach US$377.10bn in 2023.

Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 10.71%, resulting in a projected market volume of US$566.50bn by 2027.

The number of buyers is expected to amount to 2.36bn by 2027. User penetration will be 23.4% in 2023 and is expected to hit 29.7% by 2027.

The average revenue per user (ARPU) is expected to amount to US$209.40. Both Germany and the UK take the lead on the Personal Care category with the highest revenue in 2023. The UK also presents the highest growth within this category followed by Spain.

Furniture

Revenue in the Furniture market is projected to reach US$14.66bn in 2023.

Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 8.44%, resulting in a projected market volume of US$20.27bn by 2027.

With a projected market volume of US$90,380.00m in 2023, most revenue is generated in the United States.

In the Furniture market, the number of buyers is expected to amount to 33.40m by 2027. User penetration will be 31.1% in 2023 and is expected to hit 40.2% by 2027.

The average revenue per user (ARPU) is expected to amount to US$566.40. Germany is by far the country with the highest revenue followed by the UK.

Note: The market data above is provided by Statista.

About Global Savings Group:

GSG is the world’s largest shopping community, recommendation and rewards platform with an international footprint across more than 20 markets. The company’s goal is to empower consumers to get more out of life by providing them access to best savings, cashback, deals, product inspiration, reviews and other digital shopping services. Founded in 2012 and headquartered in Munich, GSG employs more than 1000 employees across the globe.