There have been plenty of headlines over the last year suggesting that e-commerce sales are slowing down, or at the very least that growth rates are slowing. One sector that has shown strong growth in recent years, however, is the Home & Garden industry. Global Savings Group data indicates that spending in this sector on our cashback platforms in France, Germany, and Spain has grown significantly in all countries in the first half of 2024.

Let’s take a closer look at the data and see what it tells us about the performance of the Home & Garden industry in Europe in recent years.

Note: for these insights, we looked at the GMV (Gross Merchandise Value) in the Home & Garden vertical on our cashback platforms (iGraal and Shoop) in the first half (H1) of 2024, and compared this to the same period in 2022 and 2023.

Spending Growth

Overall, combined spending across the three countries (France, Germany, and Spain) grew consistently between 2022 and 2024, although there was a slowdown in Germany in 2023 compared to 2022. Let’s dive into the numbers.

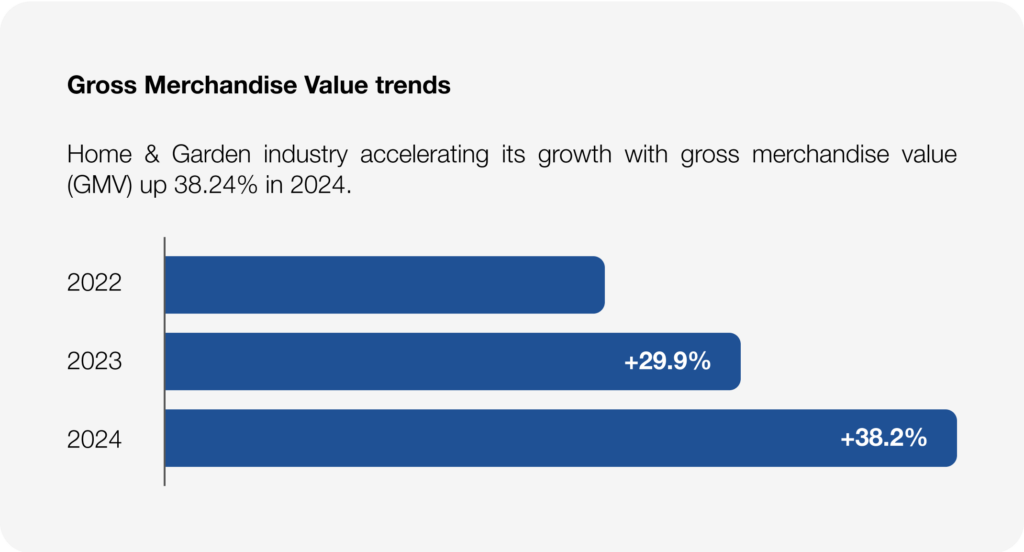

Gross Merchandise Value Trends

Home & Garden e-commerce retailers have experienced strong growth and do not appear to be slowing down, achieving a 29.9% and 38.2% year-on-year increase in gross merchandise value in H1 2023 and H1 2024 respectively. Let’s now see how this looks per country.

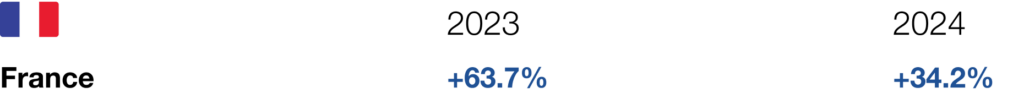

France

After a strong finish to 2023 and a great start to 2024, GMV in France is growing continuously, albeit at a slower rate in the first six months of 2024 than in H1 2023. Home & Garden spending in France increased 34% in H1 2024 compared to H1 2023.

Germany

The German market has grown considerably in H1 2024 after a slowdown in 2023. GSG data tells us that the number of transactions completed in Germany spiked in March and May of this year, indicating that consumers consider purchases in this category more carefully and shop in advance, and plan to make the most of their time spent outdoors in more favourable weather conditions.

Spain

Spending driven by GSG products in Spain continues to experience high overall growth as a result of the increasing penetration of iGraal in the country following its launch in Spain in 2020. Therefore, the Home & Garden growth figures should be taken with a grain of salt. However, the category saw growth of 52.3% in H1 2024 compared to an H1 average of 47.9% across all other categories. This, the Home & Garden industry is growing at a higher rate than average, indicating to retailers that there is a sizeable opportunity to capture active customers in this category.

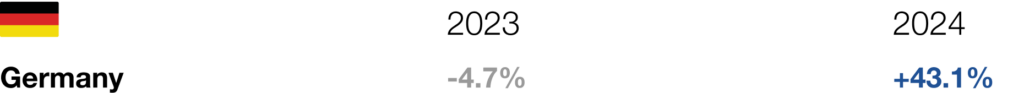

Transactions

GSG internal data tells us that transaction history has largely matched wider global economic trends, which includes the number of transactions stagnating slightly to (0.46%) in H1 2023 versus H1 2022 over economic uncertainty and recessionary periods. A more reassuring and encouraging spike is seen in H1 2024, up 28.4% versus H1 2023. Consumers have more confidence shopping in Home & Garden categories and offers e-commerce retailers more encouragement in growth going forward.

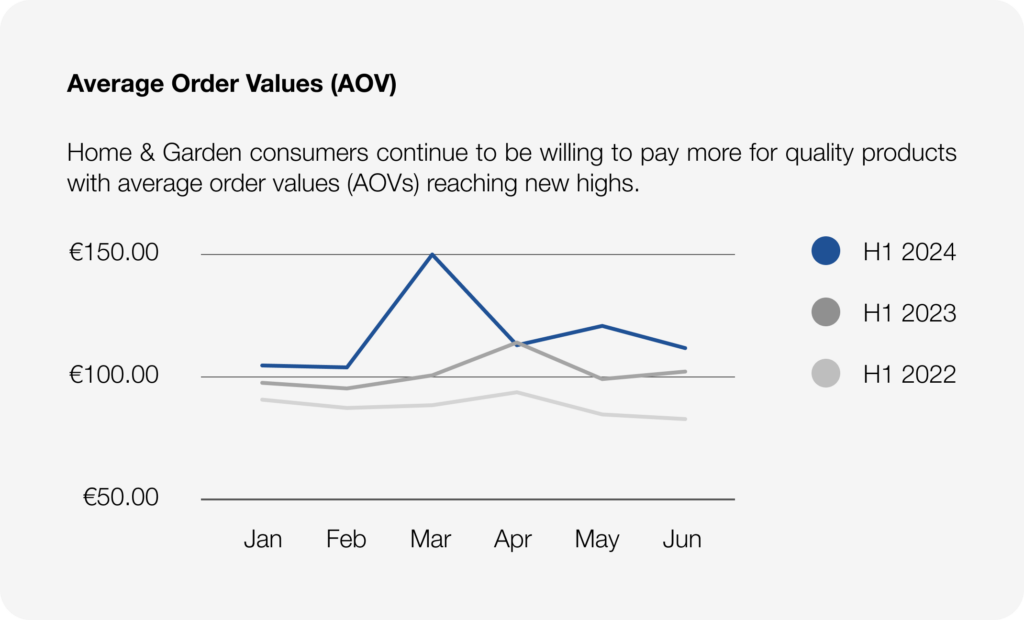

Average Order Values (AOVs)

Average order values across the markets have had small fluctuations over the months but have steadily increased over the years. Home & Garden products in 2024 have an average H1 AOV of €116.75, which is up considerably from its H1 AOV of €87.44 in 2022. Accounting for price increases due to inflation and cost of goods, consumers are willing to pay the price for home and garden decorations and improvements.

Insights from the Industry

So, how is the Home & Garden industry performing against other key industries? As mentioned, the Home & Garden category has achieved significant growth in 2024 thus far. A 38.2% increase in gross merchandise value (GMV) across all markets in 2024 for Home & Garden is considerably higher than other popular industries. The Fashion industry, for example, saw much more modest growth of 2.1% in H1 2024.

Within Home & Garden, certain sub-categories are flourishing such as pets, home improvements, and gardening to name a few. Consumers within the pet industry are spending more frequently in 2024 with transactions at one of Europe’s largest pet brands up 27.7% compared to H1 2023, highlighting more consumer activity for retailers to progress on. In Germany, home improvements are a priority for cosnumers as one of its most recognisable brands in this sector has achieved a whopping 187% increase in GMV in H1 2024. Finally, in France, the gardening sector has also benefitted from these wider upward trends; one of its largest gardening retailers in the country has achieved an incredible 157% and 175% increase in GMV and transactions respectively in the first half of this year.

It appears that the Home & Garden industry is flourishing in European markets and consumers are willing to pay a higher price for a premium quality in this category, while being rewarded for their purchases with cashback. Here’s to continued growth throughout the rest of 2024 and into 2025.